It is easy to get Car Insurance Quotes Utah online, and the process is very easy to understand. All you need to do is fill out a form, and then the comparison site will do the rest. There are several benefits to getting car insurance quotes from different companies. You will be able to compare coverage, premium, and expiration date, and also choose which features you want to be covered. It is also a good idea to compare quotes for your specific vehicle.

You can also compare insurance rates by using free online tools. These tools are completely free and don’t require you to purchase a policy. All you have to do is fill out a short form with some basic information about your car, and you’ll receive car insurance quotes within minutes. These websites will also let you know the coverage levels, policy requirements, and other policies. In addition to the comparison of premium prices, you will be able to find the best plan for your needs.

You can get a few different quotes for your vehicle based on your own personal characteristics. First, you’ll want to make sure your insurance policy covers your needs. Generally, this means carrying a certain amount of liability coverage for your vehicle. In Utah, this is $25,000 per person and $65,000 for an accident. Other minimums include property damage liability and personal injury protection. The cheapest quote will cover the minimum requirements and offer great value for money.

The best way to compare premiums is to compare the premiums of different insurance companies. Many insurance companies sell their coverage policies directly, eliminating the middleman and his high fees. With just a few clicks of the mouse, you’ll be able to get up to 15 percent cheaper car insurance quotes in Utah. You can also save on the cost of the insurance policy by using online tools. If you don’t want to go through a broker, you can also use the free online tools to compare premiums for car insurance.

You can compare car insurance quotes online for free, and you don’t even have to buy the policy to do so. All you have to do is fill out an online form to get an auto insurance quote, and you’ll instantly get a comparison. Getting a car insurance quote Utah will help you avoid a lot of hassles that come with using a broker. And the best part is that you’ll be able to compare the premiums of different insurance companies.

Whether you need to pay a monthly premium or have a yearly policy, it’s important to get the right type of coverage for you. In Utah, you should always carry the insurance card with you. It will protect you in case you need to file a claim. If you don’t have this proof, you might be paying for a policy with lower premiums. It’s very important to get a quote because you won’t be able to afford it later on.

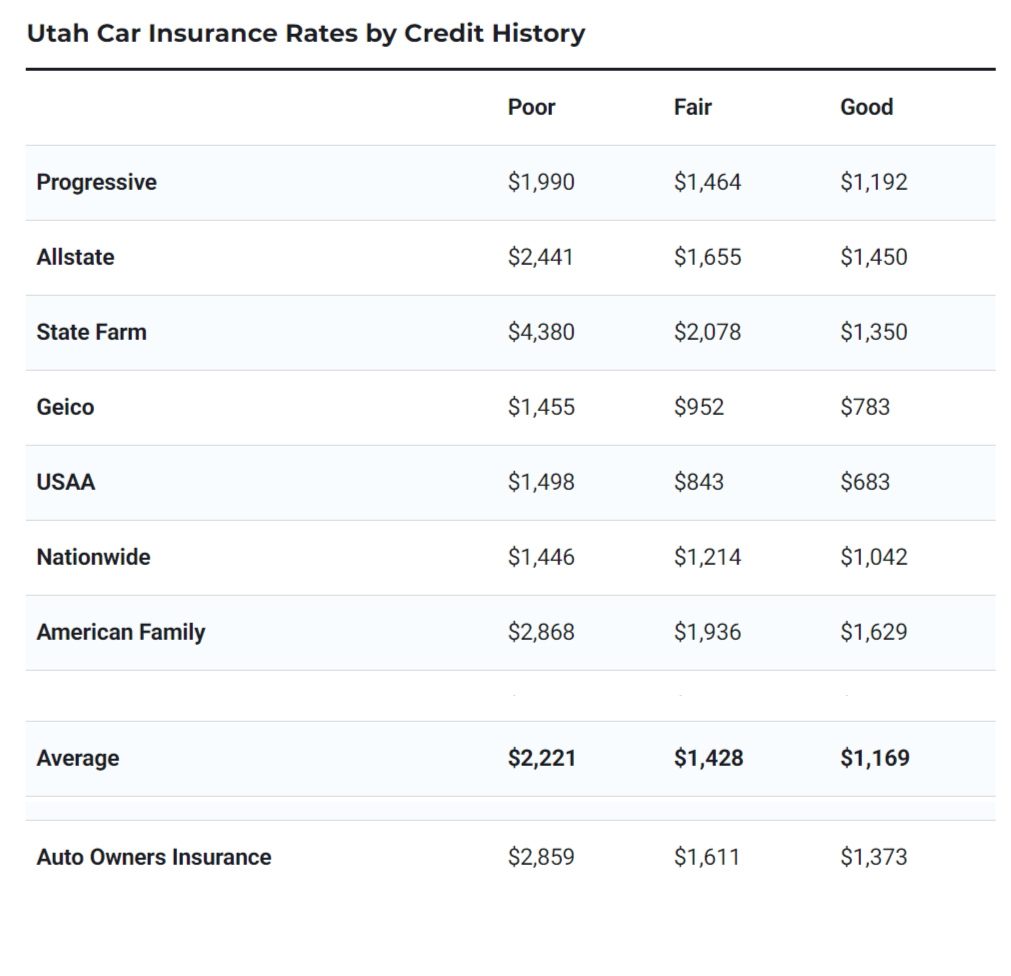

When it comes to car insurance, you’ll need to take several factors into consideration. For example, you should have a clean credit score. A good credit score can help you get a cheaper auto insurance premium. In addition, a clean credit score can help you get a better rate from a different insurer. You may even be able to save money by lowering your insurance premium. If you’re a driver with good credit, it’s best to have a comprehensive plan.

You should compare car insurance quotes from different providers. A lot of companies in Utah are promoting their coverage policies online. This way, you’ll be able to get your premium costs directly from the company, and don’t have to pay for the services of a broker. Moreover, you’ll have the opportunity to compare premium prices and other requirements of a policy. You’ll be able to get the best possible deal on your insurance.

Car insurance quotes Utah are based on your personal information and your vehicle. You should be able to get a low rate by using free online tools. These tools will also allow you to compare auto insurance quotes from multiple insurance providers, which will save you time. The best way to compare auto insurance rates is to compare the premiums of the different companies. There are many factors that affect auto insurance rates, so it is important to get accurate, detailed information.